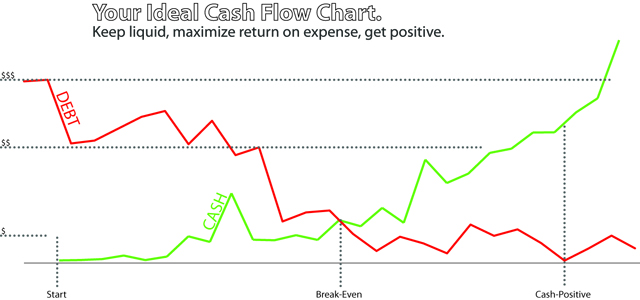

Not every business has the benefit of being flush with cash from the start. If you’re like most business owners, you’re probably balancing some level of debt against the cash coming in every month. Assuming that you’re profitable, this boils down to managing cash flow, but it can still be a huge problem. Over the years, I’ve come up with a few tricks or simple rules of thumb to maximize cash flow, turn debt into positive cash flow, and prevent cash problems. Here they are, in no particular order – take them or leave them as they are useful to your business – not all of these are perfect for everyone:

Use high-reward cash back cards to offset low interest loans

I signed up for the American Express Plum card a few years ago back when it was 2% cash back – that is significant. Now it’s down to 1.5%. As of this article’s posting (Summer 2012), the Capitol One Spark Business card is the front runner with 2% unlimited cash back. In order to make these cards work for you, you need to have a loan with some credit available to you, or enough cash to pay off the credit card every month – but let me make one thing clear before saying another word: never, ever, ever keep credit card debt. Pay it all off, in full, every billing cycle. OK? So here’s why these cards are awesome – it’s simple math – 2% per month, times 12 months, is 24%. You’re earning 24% on your monthly spending amount (2% on your annual spending). So instead of paying that in cash right out of your loan, pay it with your credit card, and then pay the credit card with cash or the loan. Here’s a quick example to show how powerful this is: assume your average monthly business expenses are $25,000. Instead of paying for these with a check, you pay with your credit card, and then pay that off with your loan. So, your monthly credit card balance is $0 (you always pay it off in full), but your loan always has a $25,000 balance. On a 6% loan, you will have spent $1,500 in interest. But you’re getting 2%, every month, on that $25,000….$6,000 over the course of a year. You’re netting out $4,500! And that helps cash flow. So if you’ve got the cash or the loan to utilize, get one of these credit cards and put as many transactions through them as you can. But always pay them off in full: credit card debt can sink a ship!

Negotiate discounts for early payment with your vendors

Ever hear the phrase “2% 10 Net 30”, or just “2/10 Net 30”? If not, it’s time to learn it, and mention it with every vendor that won’t accept your 2% cash back credit card! It’s very simple: 2/10 Net 30 simply means that if you pay your vendor invoice within 10 days, they’ll give you a 2% discount on the total, and you just cut a check for 98%. If you choose to pay within 30 days (but after 10) you lose the discount, but aren’t penalized, either. Many vendors agree to these terms. They’d love to get their money within 10 days as opposed to 30. And for you, you absolutely must pay this bill within 10 days, even if it means taking money out of your loan – the math is the same as above – you’re earning 24% annually on your monthly expenses, which far exceeds your 6% interest expense on that loan! Always ask for these terms when possible. Many vendors will agree to them happily, and no one will be insulted by your asking.

PayPal is not a bank – don’t treat it like one

PayPal is not in the business of taking and holding customer deposits, as a bank does; they are classified as a money transmitter, and more to the point, you’re on the wrong side of the money transmission equation as a small business. Why does this matter? You might get caught up like millions of other business owners (myself included) who’ve had a portion of their payments withheld with no recourse for immediate recovery. In our case, it was around 5% of all incoming payments were held for 180 days; this is a massive hit to cash flow, and if you’ve tangled your entire payment infrastructure around PayPal, you’re hosed. Think you can argue your way out of it? You can’t. They’re not a bank – you’ve willingly let them manage your transactions, and now they’re messing up your cash flow. This can technically happen with any merchant account provider, but is far less likely with companies like Chase Paymentech and Braintree. The best way to mitigate this risk is to diversify your payment methods – don’t just use PayPal – add other options to your business if possible. And never use PayPal as a checking or savings account no matter how good their interest rates are, because if they choose to hold your funding, you’re in a heap of trouble – and there’s no law saying they have to behave like a bank, and give you 100% of your money exactly when you ask for it.

Between these few tips and hacks, you can plausibly generate thousands of dollars in extra income as a result of the spending you’re already doing, and make sure that the money you’re collecting stays liquid and available for you to use. A healthy cash flow with some extra income is something everyone could use. Over the past 7 years, my businesses have easily received over $40,000 in cash back rewards – that’s significant.